Deciding between buying or renting a house is a major dilemma many of us face. It’s not a simple decision, as both options have their pros and cons. In some situations, renting can be a better option. Let’s explore.

1. High House Prices vs. Renting Costs

In today’s market, house prices are very expensive. This is particularly tough for those starting their careers or for families on a budget.

As a result, monthly mortgage payments can be large. Plus, there are extra expenses like quit rent, assessment, and maintenance fees.

In Klang Valley, a two-story terrace house usually costs around RM500,000. The monthly mortgage installment is RM2,500. Renting the same property is much more affordable at around RM1,500 per month.

Renting can be cheaper. You can use the savings for other financial goals or extra savings.

2. The Uncertainty of Property Value Increase

A common reason people rush to buy property is the fear of missing out on potential price increases.

Yet, the reality is that the real estate market has changed. Property values are not always on the rise.

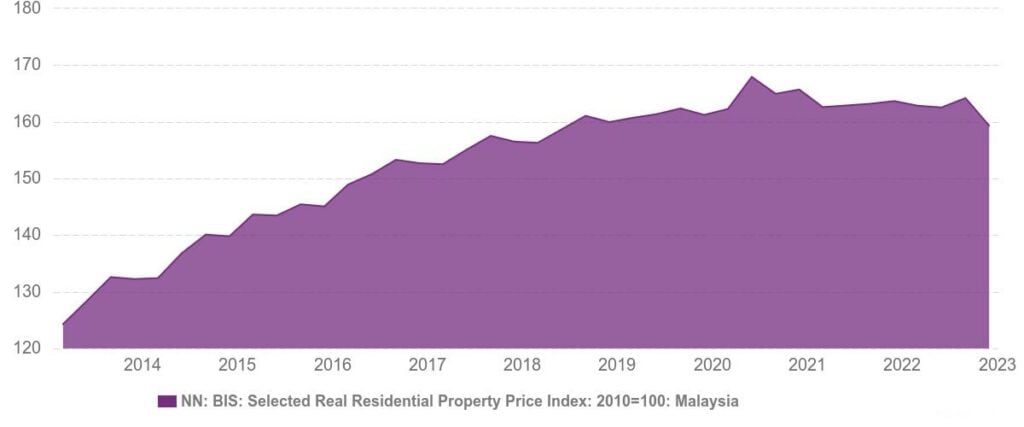

Consider this chart. As you can see, property prices in 2023 have plateaued or even decreased due to oversupply. This makes renting an appealing short-term option.

3. Readiness for the Financial Commitment

Buying a house costs a lot of money upfront. Before you can move in, you have to pay for expenses like the initial deposit, legal fees, and many other expenses.

This can be tough for young families who don’t have a lot of money saved up yet. Renting can be a lot cheaper to start.

You don’t need as much money at the beginning, which means you can manage your money better and save up over time.

4. Flexibility and Mobility Needs

Renting is super flexible. It’s great for people or families who need to move around a lot because of their jobs.

When you buy a house, you’re pretty much stuck in one place. Selling or moving can take a long time and cost a lot of money.

But if you’re renting, you can move much more easily and without all the trouble. This gives you freedom that you don’t get when you own a house.

5. Property Investment is Not For Everybody

Owning a property can be a smart investment strategy, but it’s not for everybody. Taking care of rental properties can be a lot of work and might not be worth it for some people.

A client I knew decided to sell all his rental properties. He found managing them and dealing with tenants too troublesome.

This decision sheds light on a common challenge faced by property owners. Handling rental issues can be more trouble than the rental income is worth. It involves effort and stress.

If you don’t like managing property or think you could make more money in different ways, choosing to rent instead can be a smart move.

This way, you can look into other ways to invest your money without the hassle of dealing with property.

6. Mitigating Financial Risks

Renting involves less financial risk compared to buying a house with a mortgage. Owning a home comes with a significant financial burden.

It may need sacrifices in other areas of your budget. Additionally, mortgage interest rates can fluctuate, impacting your monthly payments.

Renters are not affected by these risks. Renting offers more stable and predictable living expenses.

7. Lack of Knowledge in Homebuying

Navigating the housing market can be daunting. Understanding the complexities of buying a home can also be daunting. Without adequate knowledge, you risk making a poor investment.

Read also: Residential properties up for auction increased in 2Q2023

Renting allows you to take your time to learn about the market. It helps you build your finances. You can make a more informed decision when you are ready to buy.

Summary

In summary, many people think owning a home is the best goal. Yet, it’s important to consider your financial readiness and future plans before deciding. It’s not about which choice is better for everyone. Instead, choose what’s better for you now and for your plans ahead.

Before I conclude, I urge you to read the article I wrote on 8 Reasons Why You Should Buy a House Now in Malaysia. It explains why now is the perfect time to buy property, which adds to this discussion.